How to Improve Your Marketing to European Executives

June 09, 2023

For the first time, we now have a more complete view of how executives make decisions, form perceptions about places and work with investment promotion agencies on both sides of the Atlantic.

Every three years since 1996, DCI has released its Winning Strategies in Economic Development Marketing study, providing a roadmap for the types of information executives and site selection consultants seek and how to influence them. With the launch of our European joint venture C Studios in early 2023, we wanted a similar compass to guide our decision-making as marketers.

Launched under a similar title, Winning Strategies in Investment Promotion Marketing helps us see that many of the same habits we have come to see from U.S. executives are, in fact, transcontinental. That said, there subtle differences, which we’ve recapped below.

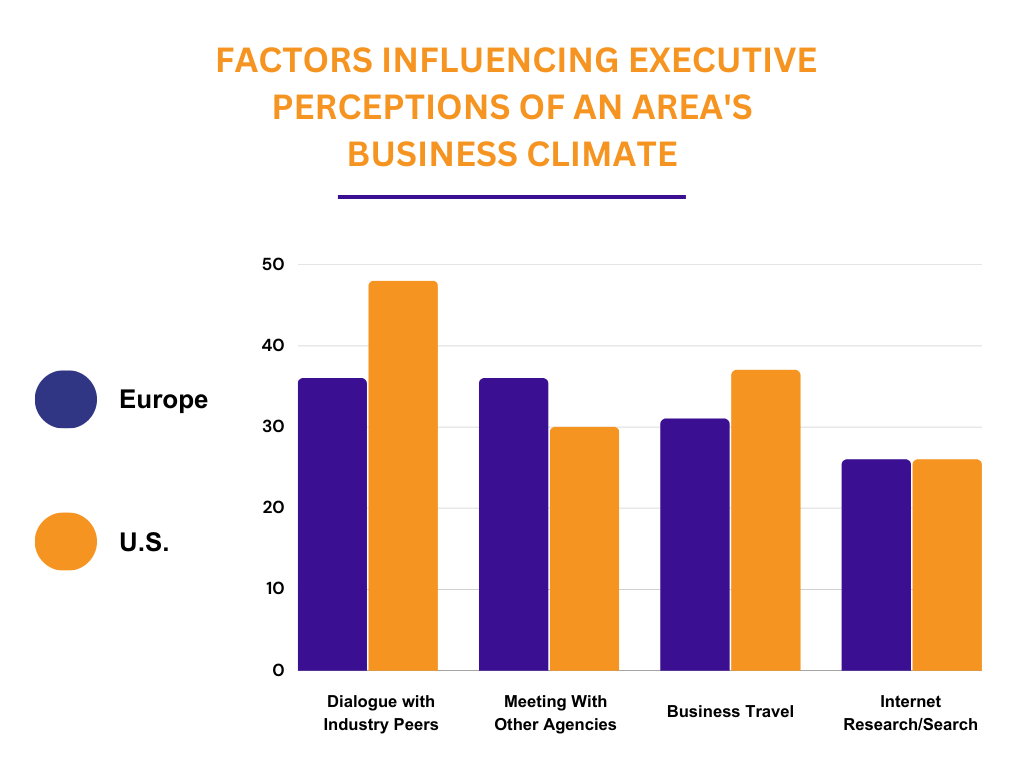

Influencing Perception in Europe is More Mixed

The factors influencing executive perceptions of an area’s business climate were in much of the same order in both regions, but the European responses were not as distinct. “Dialogue with industry peers” was way ahead of any other factor in the U.S. with 48% of executives selecting the option, whereas in Europe, the same category was tied for first (along with “Meetings with IPAs”) at just 36%. In reviewing the rest of the data, the percentages are much closer in value among European respondents, signifying that influencing perception abroad is an even bigger challenge than in the U.S.

Most Useful Features of a Website

In both surveys, we ask about the most useful features for executives on an economic development or investment promotion website. Similar to above, there are quite a few similarities, with tax/incentives and demographic information the top 2 in both reports among corporate executives. One difference we saw, however, was how in-demand information about “Quality of life” is, which surprisingly only drew responses from 23% of European executives compared to 42% of their U.S. counterparts. Another one was the prevalence of a “Searchable database of available buildings and sites” in Europe (it ranked third most at 40% versus just 32%, or 6th, in the U.S.).

Executives Most Likely to Lead Location Decisions

We know from talking to executives directly as well as from surveys around the marketing industry that the B2B decision process often involves a larger team of 5+ individuals. But who leads the decision team and has the ultimate say? When asking about which executive is most likely to do so, both regions listed the Chairman/CEO/President as No. 1, but the second most common executive was the difference. In Europe, Chief Operating Officers were chosen 21% of the time, compared to just 12% in the U.S. (where COOs placed 4th). Meanwhile, in the U.S., Chief Financial Officers were the second-most common at 16%, compared to 7% in Europe (where CFOs placed 6th).

Survey data like this underscores the regional variations worldwide in business recruitment. But not all data points varied. In fact, one important area where there is little distinction is how executives utilize IPAs in their decision-making process. In Europe, only 28% of companies reach out to IPAs or EDOs during the screening phase; in the U.S., about 35% of companies say the same. In short, that’s about two-thirds of companies that are progressing through much of the research process without input from the local authorities.

This is where marketing can fill the gap – creating meaningful touch-points earlier in the process to help your community stay in the game.

You can download the European-focused Winning Strategies in Investment Promotion Marketing here. And you can download the U.S.-focused Winning Strategies in Economic Development Marketing study here.